德鲁·格林布拉特相信,伟大的平衡器终于要来了。

多年来,南巴尔的摩一家钢铁制造厂的老板格林布拉特一直在恳求有人采取行动对付其他国家的“作弊者”——尤其是中国。

格林布拉特说,他的公司Marlin Steel与享有丰厚政府补贴的外国工厂竞争,这些工厂窃取他的知识产权并通过无视环境和安全标准来削弱他的业务。

最终,美国准备反击。 或者至少,格林布拉特希望如此。

周六,唐纳德·特朗普总统誓言对美国最大的贸易伙伴——墨西哥、加拿大和中国征收关税。 但这些关税的力度如何——以及哪些行业可以获得豁免——尚不清楚。

关税是对其他国家产品征收的税。 它们提高了消费品的价格并扰乱了全球贸易。 据格林布拉特称,关税也可以拯救美国制造业。

“这是桑镇对上海,”格林布拉特说,指的是西巴尔的摩的桑镇-温彻斯特社区。 “这就是这一切的意义所在。”

经济学家警告说,关税将导致通货膨胀、经济增长放缓,并导致一些人失去工作。 但影响不会对每个人都一样。 会有赢家和输家。 格林布拉特认为他的公司——以及巴尔的摩——将会获胜。

“这非常重要。 这不像理论上的象牙塔,‘让我们在哈佛讨论这个,‘”格林布拉特说。 “不,这就像,‘德鲁将从桑镇雇佣人。‘”

格林布拉特如此坚信关税会促进他的业务,以至于他说他最近从芝加哥的一家公司购买了一台价值30万美元的新机器。

格林布拉特说,马林钢铁公司成立于1968年,在巴尔的摩雇佣了大约40名员工。 他们主要制造用于医疗行业的钢篮。

格林布拉特说,工资从每小时20美元起,随着时间和经验的增加而上涨,福利包括医疗保健、休假、401(k)匹配和加班机会。

正是这样的工作岗位曾经吸引了数以百万计的欧洲穷人、美国南部和阿巴拉契亚地区的移民来到像巴尔的摩这样的城市。 中国制造商的崛起和国际贸易政策的变化摧毁了美国制造业。 交通运输的变化对巴尔的摩也没有帮助。

Baltimore’s position on the Chesapeake Bay and its railroad lines to the Midwest once enticed factories. The creation of the interstate highway system in the 1950s and the rise of trucking allowed factories to set up shop in rural areas and southern states, Adam Scavette said in an interview last year, when he was a Baltimore-based economist for the Federal Reserve Bank of Richmond.

Those regions were attractive for factories because of relatively cheap land and non-union labor, Scavette said.

Today, the Baltimore region has one of the lowest rates of manufacturing jobs of any major metropolitan area in the country, 2023 federal data shows. Just 4% of its workers are employed in manufacturing.

To Greenblatt, this is the moment to resurrect Baltimore’s manufacturing industry and bring people out of poverty. He shouted his points to be heard above the noisy factory.

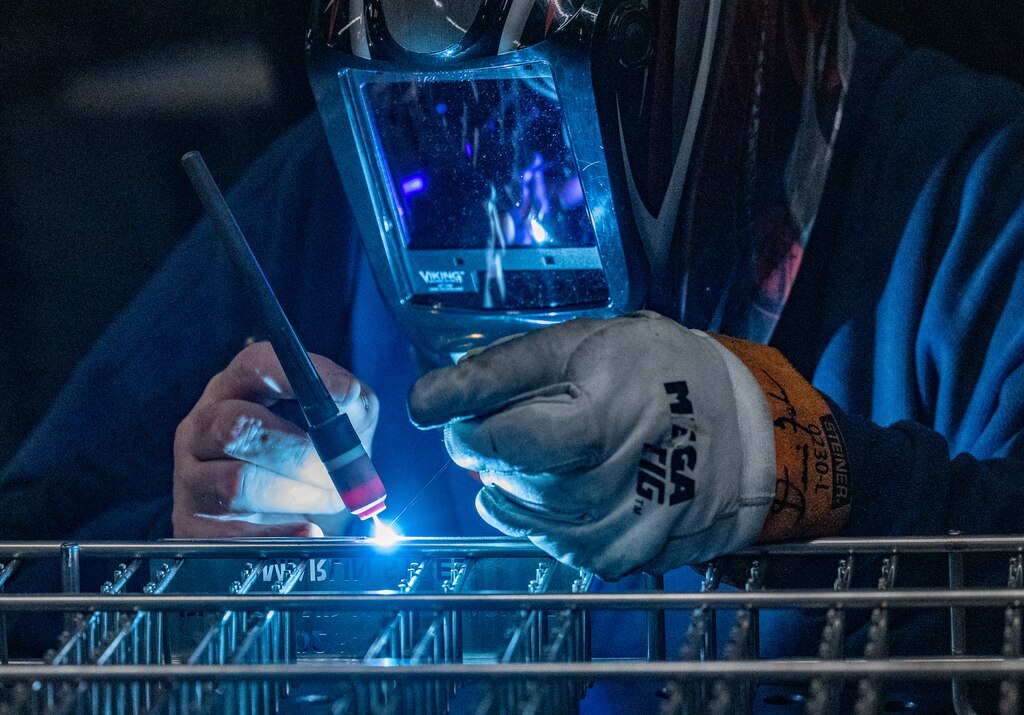

A forklift beeped. A steel press hissed. Welding torches crackled. The repetitive thumping of a machine pulsed like a heartbeat as it unspooled thick wire and cut it into rods of steel.

The steel came from a Tennessee plant that recycles old dishwashers, cars and other refuse, Greenblatt said, so he isn’t worried when some economists warn that tariffs could hurt factories that rely on Chinese steel.

“I’m buying American steel. I’m using American labor,” Greenblatt said. “I’m pretty bullet-proof.”

Most major U.S. corporations have far more complex supply chains, said Hung-bin Ding, an associate professor at the Sellinger School of Business and Management of Loyola University Maryland.

Apple, for example, doesn’t really make iPhones, Ding said. It’s more like a research and development firm with a marketing wing, he said, and it relies on about 200 contractors scattered across the globe to make phones.

This strategy allows companies to be nimble and make their products as cheaply as possible, Ding said. Tariffs would upend this system, he said, but it might steer business to smaller U.S manufacturers like Marlin Steel.

It depends on how sweeping Trump is with tariffs, said Tinglong Dai, a professor of operations management and business analytics at Johns Hopkins’ Carey Business School.

In his first term, Trump largely exempted some companies, including Apple, Dai said, because they were viewed as integral to the U.S. economy or national security.

Dai said powerful CEOs are probably lobbying the Trump administration about this issue right now. And those CEOs have a lot more clout than the owner of a midsized steel fabrication company based in Baltimore.

Still, Greenblatt, who declined to say whom he voted for, said he believes Trump will enact most of the tariffs he promised last year on the campaign trail.

He walked over to a 230-ton press break that can snap off a finger like a horse eating a carrot. He gestured to an employee, Frank McQueen, and then pointed at a beam of light that triggers the machine to shut down before any accidents.

“My competition in China, they lose the finger, they fire the guy,” Greenblatt said. “I love Frank. I want good things for Frank. So we put on the $20,000 light bar.”

Steel manufacturing is one of many industries subsidized by the Chinese government, which allows companies to flood international markets with cheaper products. Last year, China had a trade surplus of nearly $1 trillion, a figure that is unparalleled in modern history.

The U.S. also directly subsidizes some industries. Under the Biden administration, Congress passed the CHIPS Act, which is pouring billions of dollars into American-made semiconductors.

Scott Paul, president of the Alliance for American Manufacturing, would like to see both approaches. Tariffs slow the flood of cheap imports, Paul said, and subsidies spur private investment into new domestic factories.

“Tariffs alone aren’t going to revitalize manufacturing in Baltimore,” Paul said, but they could give some breathing room to a company like Marlin Steel.

Comments

Welcome to The Banner's subscriber-only commenting community. Please review our community guidelines.